Section 1: Introduction of IAS 19 standard

In June 2011, the International Accounting Standards Board (IASB or the Board) issued revisions to IAS 19 Employee Benefits (the ‘revisions’, ‘IAS 19R’ or ‘revised standard’) that provide significant changes in the recognition, presentation and disclosure of post-employment benefits. IAS 19 R is an accounting standard that describe the accounting and reporting requirements to value various employee benefits

under IFRS.

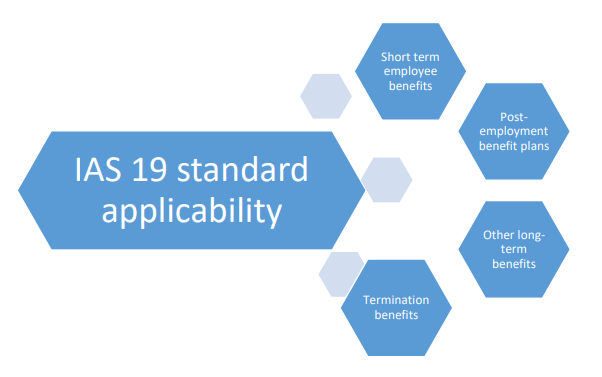

The Standard identifies four categories of employee benefits:

1. Short-term Employees benefits are expected to be settled in next 12-month, but do not include termination benefits. Eg: Wages, Salaries, Profit sharing, Bonuses etc.

2. Post-employment benefit plans are formal and informal arrangements with employees, where the company pays End of Service Benefits (EOSB), Post employment medical care, Post employment life insurance etc.

3. Other long-term benefits are employee benefits other than short-term employee benefits, post-employment benefits and termination benefits. Measurement is similar to defined benefit plans. Such as Leave encashment, Long term disability benefits etc.

4. Termination benefits are employee benefits provided in exchange for the termination of an employee’s employment.

Section 2: Timelines for IFRS implementation in the Kingdom of Saudi Arabia (KSA)

The International Accounting Standards Board (IASB) has shared a vision of one global accounting standard. Adhering to the vision of IASB, the Saudi Organization for Certified Public Accountants (SOCPA) had decided to apply International Financial Reporting Standards as endorsed in Kingdom of Saudi Arabia (referred hereafter as IFRSs) to all listed and unlisted companies. All the Listed companies in Saudi Arabia (176 Companies listed on Saudi Stock Exchange or Tadawul) were required to adopt and prepare the financial statements from January 1, 2017 under IFRS and all the unlisted companies to adopt the practise since January 1, 2018. IFRS in Saudi Arabia will be similar to the standards issued by the IASB with possible three modifications in these respect:

• Adding more disclosure requirements

• Removing optional treatments; and

• Amending the requirements that contradict Shariah or local law, taking in consideration level of technical and professional preparedness in the Kingdom.

Section 3: Brief about Methodology, Assumptions and Disclosures

An entity shall use the projected unit credit method to determine the present value of its defined benefit obligations and the related current service cost and, where applicable, past service cost.

The projected unit credit method requires an entity to attribute benefit to the current period (in order to determine current service cost) and the current and prior periods (in order to determine the present value of defined benefit obligations). An entity attributes benefit to periods in which the obligation to provide post-employment benefits arises. That obligation arises as employees render services in

return for post-employment benefits that an entity expects to pay in future reporting periods. Actuarial techniques allow an entity to measure that obligation with sufficient reliability to justify recognition of a liability.

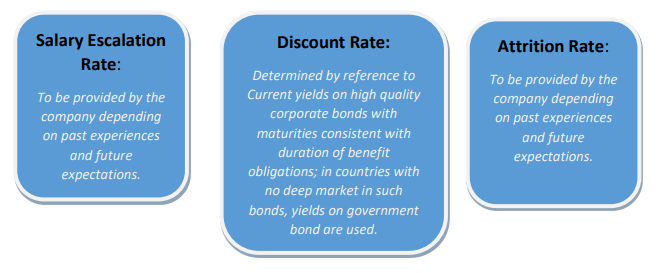

To ascertain the actuarial liability there are some assumptions to be made namely Salary escalation rate (the rate at which the salaries of the employees are expected to rise), Attrition/Withdrawal rate (the rate at which the employees leave the company) and the Discount rate.

Once the valuation is complete, then not only Present Value of Obligation (liability number/ provision amount) and expense number is important, but also how the numbers react with change in assumptions, the current liability (Liability to be paid within next 12 months) and the evaluation on past assumptions is also necessary.

IAS 19(R) standard demands for following disclosures other than the Liability and Expense numbers.

• Bifurcation of Actuarial Loss and Gain: Actuarial loss and gain number is bifurcated with respect to changes in financial assumptions (Salary escalation and Discount rate), change in demographic assumption (Attrition rate) and change due to experience (gap between actual and expected assumptions and data).

• Sensitivity Analysis: Making small changes in the inputs (salary escalation rate, attrition/withdrawal rate and discount rate), their impact is studied on the Liability number to see how sensitive it is to the assumptions.

• Maturity Profile: It is a brief of undiscounted future cash flows based on the current assumptions. Some Companies also demand for the same on discounted basis.

Section 4: How we can help you?

Mithras, One Stop to all actuarial solutions, is an actuarial consultancy providing its clients with all types of Employee benefits valuation under IFRS including End of Service Benefit (EOSB), Leave valuations, Pensions and others covered under IAS19 R.

Actuarial Valuations are nothing but ascertaining the liabilities keeping in mind the past experiences and future expectations. There are certain factors on which an actuarial valuation depends. Data and Assumptions are the two main factors that are not in our hand and are client specific. What we do is to eliminate all the possible errors from the data. The other two factors which are Mithras USP are Number analysis and Disclosures. We make sure that the liability numbers from the previous year are consistent with current year liability numbers. Our reports provide all the necessary disclosures required as per ‘IAS 19R’ and are user friendly.

All the valuations are point specific and based on employee level. One can observe the contribution of each employee in the actuarial liability.

We are a team of individuals, who are dedicated and trained to provide clients the best assistance and guidance of the regulatory framework, measuring and optimising liability and solving all the client queries related to valuation.

Disclaimer: This above note is based on knowledge sharing information. The information should not be relied upon as advice on your specific circumstances. Neither Mithras Consultants nor any person connected with it accepts any liability arising from the use of this document. The above note is not providing any recommendations.