Attrition rate on ESB and its Impact on End-of-Service Benefits

End of Service Benefits is payable to employees who are serving or working in Companies or organizations established in the United Arab Emirates (UAE), the Kingdom of Saudi Arabia (KSA), and similar middle east countries. The level and type of benefits payable are different in each country based on the number of years of services and the regulations which are applicable in their respective countries.

The actuarial valuation is done to value the end-of-service Benefits so that appropriate provisions can be made in the financials. Generally Projected Unit Credit method (PUC method) is used for actuarial valuation, this method requires assumptions like salary growth rate, attrition rate, discount rate, etc for the calculation of actuarial liability.

The attrition rate is one of the important assumptions used for the calculation of actuarial liability as liability numbers are very sensitive to this assumption.

In this article, we will show the calculation of actuarial liability (Present value of obligation), of end of service benefits offered in the UAE with the help of an example.

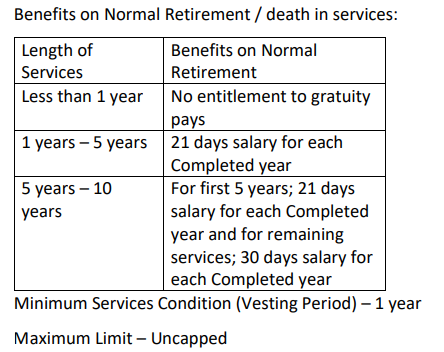

End of service Benefits Offered in UAE (United Arab Emirates)

Benefits on Normal Retirement/death in services:

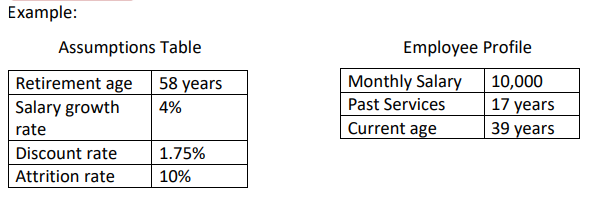

As per this example, actuarial liability (Present value of obligation) will be AED 185,103.

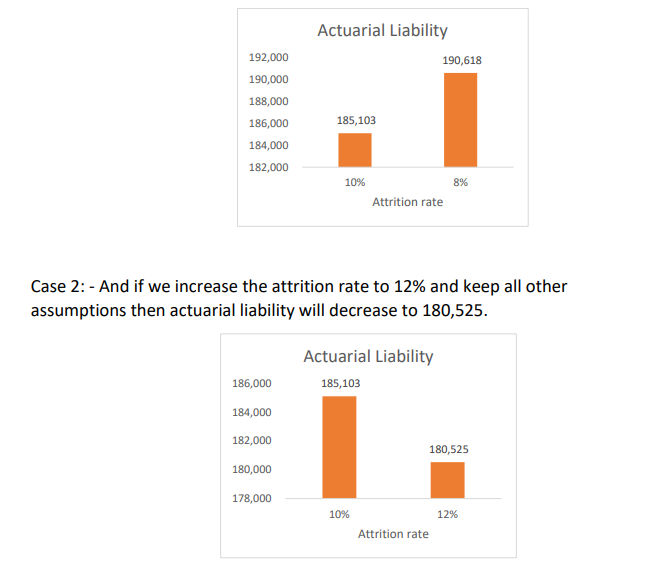

Now, we will look at the liability for two different scenarios.

Case 1: – If we decrease the attrition rate to 8% and keep all other assumptions the same then actuarial liability will increase to AED 190,618

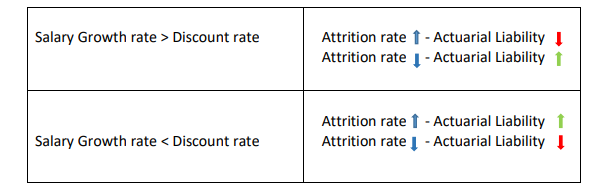

Impact of attrition rates on End of Service Benefits Liability. If the Salary growth rate assumption is higher than the discount rate then with a higher

attrition rate there will be a lower actuarial liability. If the Salary growth rate assumption is lower than the discount rate then with a higher attrition rate there will be a higher actuarial liability.

The following table summarizes the impact of attrition rate on actuarial liability.

However, there are exceptions to the above rules, if the organization is new and due to a vesting period higher attrition rate could also result in a lower actuarial liability even when salary growth rate assumptions are less than the discount rate because higher attrition means more people will leave the organization before completing their vesting period or to become applicable for benefits payout.