Section 1: Introduction

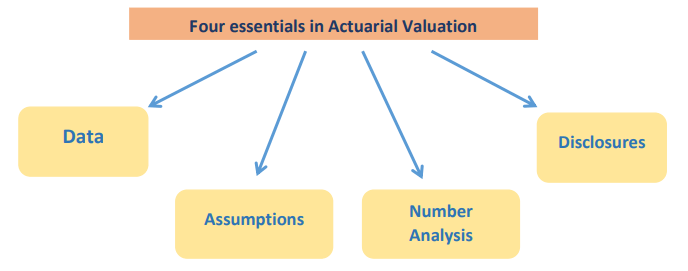

An actuarial valuation is a mathematical analysis performed using various inputs and assumptions in order to estimate a future liability or asset as of a different point in time. Valuations guide appropriate changes and decisions necessary to sustain the long-term viability of the fund. The inputs of an Actuarial valuation are Data and Assumptions, which helps to produce meaningful results and communicable Disclosures. The Purpose of an Actuarial Valuation is to provide the results which are sufficient enough to make decisions from use of raw data keeping in mind the probability of future changes. This article focuses on the effects of 4 factors one must check while carrying out an actuarial valuation.

In this article, we will only concentrate on liability side. Asset value is usually provided by the clients and shall be taken as it is after reasonable checks.

Section 2: Key Factors of Actuarial Valuation of Employee Benefits

1. Data:

The goal is to transform the data into information and information into insight. The data needed for actuarial valuation is mostly Employee data related to salaries, Date of Joining, Date of Birth and benefit structure. There are some basic checks we always perform to ensure whether the data we use is reliable or not. The data is processed in following steps

• Completeness: The basic and the foremost step to process a data is to check if it is complete and all the fields in data are readable.

• Formatting: The next step is to check that the data for all the records are in same format. If not then the challenge is to convert all the entries in a standard format. For eg: Most of the times the problems are faced by us in date formats (MM/DD/YYYY or DD/MM/YYYY) provided to us by various clients.

• Duplicacy: This type of data error is common when dealing with the data of various branches in an entity. What we need to check is that there is only one unique entry for each employee and also that any entry for a particular field (for eg: same DOB for 50% employees) is not repeated several times. The elimination of such errors in data becomes difficult if the employee codes or unique identification number is missing.

• Consistency: Once the data for the current valuation period is checked the next task is to check the data with the previous records saved in our database. The data provided for the two periods must be parallel to each other and the changes (like increase in salaries) must be reasonable.

• Missing Entries: One of the simple checks is to look for any missing data fields (e.g. salary of an employee is not provided) and then ask again for the correct data from the Client. According to our experiences what we advise is to Keep Calm and Use the Data Wisely.

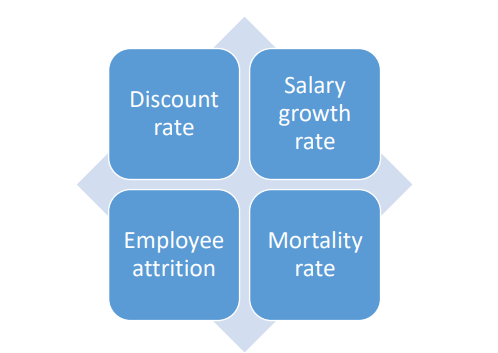

2. Assumptions: Results obtained from an Actuarial Valuation are nothing but a proper blend of assumptions. More valid the assumptions, more reliable the results. The assumptions we use for calculating the liability is based on the past experiences and future expectations by the company (Attrition rate and Salary Growth rate). When there is less evidence of past and future experiences an industry average can be used for ascertaining liabilities.

Different Assumptions impact the liability numbers differently. To check the impact of assumptions we make small changes in the base assumptions and observe its effects on liability number. This process is called sensitivity analysis.

3. Number Analysis:

Once the inputs to the model are set (Data and Assumptions), the nect task is to analysis of the obtained results. The figures we need to analyse are the liability and expense numbers. They should be consistent with the accrued liability as well as with previous year’s results.

Below are the few parameters which bring change to the liability numbers:

• Change in assumptions: As the actuarial valuation depends on assumptions, hence change in assumptions from previous valuation period impact liability numbers. An increase (decrease) in salary inflation rate leads to increase (decrease) in liability causing financial loss (gain) to the company. Similarly, Demographic loss or gain is caused by the change in attrition assumption.

• Gap between the Actual and Assumed: There are certain assumptions we make while doing actuarial valuation and when the expected assumption differs from actual, experience gain or loss arises. For example, Actual Salary growth rate of 8% versus assumed salary growth rate of 5% leads to loss due to experience.

• Accrued versus Actuarial: Accrued liability is the liability company needs to pay if the business is to be shut today. In case of gratuity benefits, it is usually calculated on the basis of service already accrued by the employee without any future expectations. Accrued gratuity is equals to 15/ 26 * Basic Monthly Salary * Completed years of service

We calculate a ratio of Actuarial: Accrued liability, it is less than 100% when salary growth rate is less than the discount rate and vice versa.

4. Disclosures:

The best way to make someone believe in our work is to make it presentable and easy to understand numbers as per prescribed disclosure formats as mentioned in Actuarial practice standard or accounting standard. The objective of any study is to communicate it, Actuarial valuations are no exceptions. And thus disclosures must contain all the information which is required as per the Accounting Standards. The new accounting standard IndAS-19 provides more clarity and disclosures to information to promote transparency and eliminate ambiguity.

Our focus is to convey all the information regarding the valuation and to do Crystal clear Reporting. And thus all the assumptions, Data summary, Rules (leave policy, Salary used for valuation etc.) along with the results are disclosed in the report. The complete disclosure of

information not only helps us to avoid future confusion but also prevents loss of information.

We have covered the basic points around which an actuarial valuation of employee benefits revolves. With increasing expertise one can spend more time with data and study the impacts by changing assumptions and factors used. Each Valuation is new in itself, one need

to hammer their mind and understand what the numbers are trying to speak.

Disclaimer: This above note is based on knowledge sharing information. The information should not be relied upon as advice on your specific circumstances. Neither Mithras Consultants nor any person connected with it accepts any liability arising from the use of this

document. The above note is not providing any recommendations.