Gratuity Provision an its Needs

What is Gratuity?

When you work with dedication for a long period for an organization, you want your organization to repay you in some form. Gratuity is one method by which corporations recognize and reward the work and dedication of their employees who have been with the company for at least 5 years.

The Payment of Gratuity Act of 1972 requires employers to pay gratuities to their employees. This act requires all employers to pay a sum of money to every employee who has worked for them for at least 5 years after applying Gratuity Provision.

Gratuity is a benefit plan that is paid to an employee as part of his or her compensation and is intended to support the employee.

The sum paid by an employer to its employees for performing services for 5 or more years is the definition of a gratuity.

Gratuity is a benefit plan that is paid to an employee as part of his or her salary and is intended to help the employee in retirement.

Employees are entitled to a gratuity in the following circumstances: – The individual should be let go from his or her position.

The employee should be able to participate in superannuation. After five years of service with any one business, the individual should have resigned. If an employee dies or becomes disabled as a result of disease or an accident.

Table of Contents

How you can do the Calculation of the Gratuity provision?

While you can use a gratuity calculator to determine the amount of gratuity you would receive after 5 years of service with an organization or upon retirement, you can also use a gratuity calculation formula to do the same thing. Gratuity Provision is a term necessary for the employee.

Because gratuity is governed by the Payment of Gratuity Statute 1972, the rules and computations for gratuity are outlined in the act.

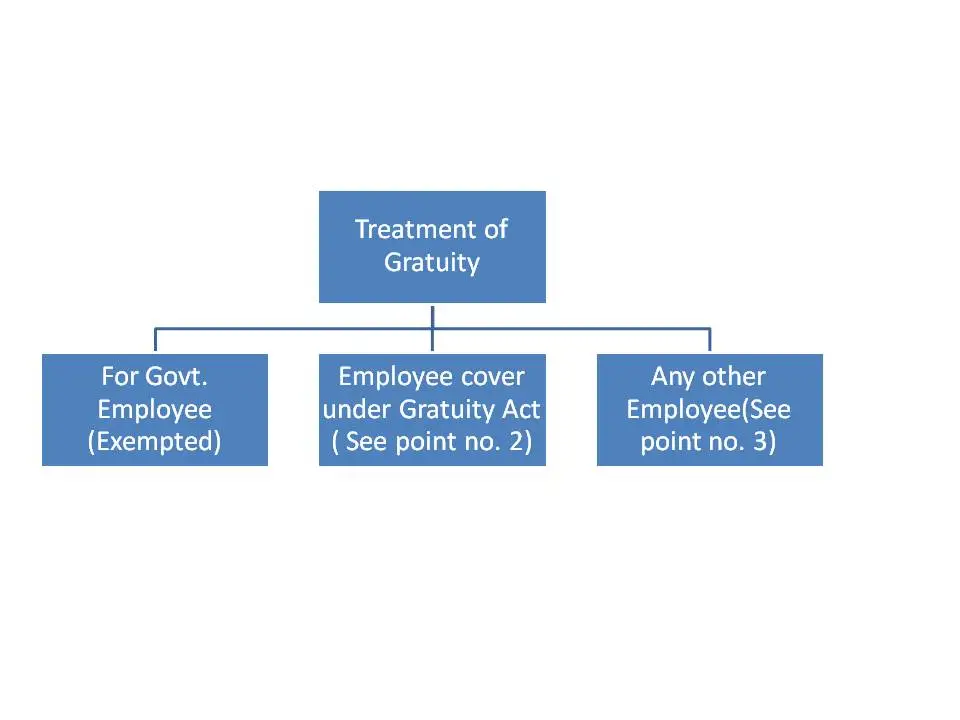

According to the statute, gratuity is paid in two ways: for employees who are covered by the act and for those who are not. Gratuity is paid to the employees after applying the Gratuity provision methods.

For workers who are not covered by the act. Gratuity for employees in both of these groups is computed differently, as explained below-

Gratuity Calculation Formula for Employees Covered by the Act:

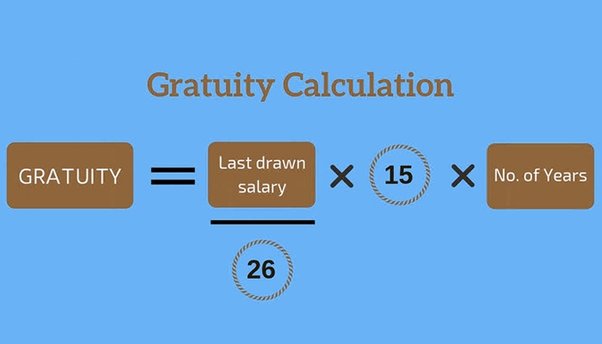

To calculate the gratuity for employees covered by the legislation, first, determine the number of years of service and the employee’s last drawn salary, and then apply this formula. Gratuity = last drew wage * (15/26) * a number of years of service.

In this case, the number of working days is taken to be 26 days, and the gratuity computation accounts for wages of 15 days.

It should also be noted that the latest drawn salary should be computed to account for the employee’s basic wage, dearness allowance (for government employees), and sales commission after doing gratuity provision.

Why choose MITRAS CONSULTANT?

• Highly recommendable – it is highly recommended financial institutions, charted accountants, and other experts recommend the Mithras consultant. It has a 4.3 rating, and A+ customer reviews. Gratuity Provision must be known for all the employees.

• Satisfaction – satisfaction is very important for the clients, there are 1800+ satisfied clients. And they seem very happy today that they get their entire problem solved within days and they get the best suggestion and recommendations.

• Work fast – the company is working in a faster mood. They want as early as possible they can solve the client with done and they are taking the step to clear all the problems of the clients.

• Easily available – the company is easily available. You don’t need to do so many formalities and so much wait. You only need to take the decision to consult with MITRAS CONSULTANT

• Friendly environment – they give a friendly environment to their clients, where they can say their problems and situation without any hesitations and they feel free to ask any questions because the company understands that they have to know the entire situation then they can solve the situation in a good manner and in a better way. As they know that a good listener can solve the problem.

• Expert members – the gratuity provisions are so complicated to understand. Its formula is so complicated, and its provisions are so complicated but the company has expert members who make the complicated issue easy to be easily understood by you. You can easily understand and you can relax after the meeting because the expert members have started the working on tour project.

• Successful project – the clients get their project or deduction completed. 1800+ projects have been completed by the company and all are success full.

• Happy clients – their one theme is to make the clients happy by solving their problem and by taking their situation as their own and they can solve the issue and makes the clients happy.

What is Gratuity Act 1947? How Gratuity Act Helps Employees?

A gratuity is a monetary amount paid to an employee of an organization under the Payment of Gratuity Act of 1972. This is mostly given to the employee as a gesture of appreciation for his or her contributions to the company.

The Gratuity Provision payment is one of the components that make up the employee’s gross wage. However, an employee is only eligible for the gratuity if they have worked for the company for 5 years or more.

It is typically a small amount offered by the employer to express gratitude to the employee for their contributions to the organization. With the help of this act, employees get gratuity after applying Gratuity valuation and gratuity provision.

This Act is established to provide for a program for the payment of gratuity after applying gratuity provision and gratuity valuation to employees working in factories, mines, oilfields, plantations, ports, railway companies, stores, or other facilities, as well as items related to or incidental to those activities.

It applies to the entire country of India, with the exception of plantations and ports, which are not applicable to the state of Jammu and Kashmir.

The provision of this Act shall apply to –

- Every factory, mine, oilfield, plantation, port, and railway company.

- Every shop or establishment within the meaning of any law currently in force in relation to shops and establishments in a State in which ten or more persons are employed, or were employed, on any day of the year.

- Other establishments or classes of establishments in which 10 or more employees are or were engaged on any day over the preceding twelve months, as specified by the Central Government by notification.

What is AS 15?

Accounting Standard (AS) 15, Employee Benefits (updated 2005), issued by the Council of the Institute of Chartered Accountants of India, takes effect for accounting periods beginning on or after April 1, 2006, and becomes mandatory on that date like gratuity provision and gratuity valuation.

(a) In its entirety, at any point during the accounting period, for firms that fall into any one or more of the following categories:

- Enterprises whose equity or debt securities are listed in India or elsewhere.

- Enterprises that are in the process of listing their equity or debt securities, as demonstrated by a resolution passed by the board of directors. Banks, including cooperative banks

- Financial establishments through gratuity provision.

- Companies that conduct insurance business.

- All commercial, industrial, and business reporting businesses with a turnover of more than Rs. 50 crore in the immediately preceding accounting period based on audited financial statements. ‘Other income’ is not included in turnover after applying methods of gratuity provision.

- All commercial, industrial, and business reporting businesses with borrowings, including public deposits, in excess of Rs. 10 crores at any point during the fiscal year.

- Any of the foregoing holding and subsidiary firms at any point during the accounting year.

(b) in its entirety, with the exception of the following, for firms that do not fall into any of the categories:

- Above and employ 50 or more people on an annual basis on gratuity provision.

- Paragraph 46 and 139 of the Standard, deals with discounting amounts due more than 12 months after the balance sheet date.

- Recognition and measurement principles are laid out in paragraphs 50 to 116, as well as presentation and disclosure requirements laid out in paragraphs 117 to 123 of the Standard, in respect of accounting for defined benefit plans.

However, such businesses should actuarially determine and plan for the accrued liability in respect of defined benefit plans like gratuity provision as follow:

- For actuarial valuation, the Projected Unit Credit Method should be utilized.

- The discount rate should be established using market yields on government bonds at the balance sheet date, as specified in paragraph 78 of the Standard.

- Such businesses must disclose their actuarial assumptions in accordance with Standard paragraph 120(l).

(c) In its entirety, with the exception of the following, for businesses that do not fit into any of the categories:

- Above and have fewer than 50 employees on average during the year.

According to the Payments of Gratuity Act of 1972, a Gratuity is a sum paid by an employer to its employees for services rendered for at least 5 years after gratuity valuation and gratuity provision.

Gratuity is a benefit plan that is paid to an employee as part of his or her salary and is intended to assist the employee in his or her retirement.

Employees are entitled to receive the gratuity amount if they are retiring from their service after adopting the gratuity provision, are qualified for superannuation, have resigned after completing 5 years of service with any one company, or have died or become disabled due to disease or accident.

Also Read: Actuarial Valuation of Gratuity, IND AS 19, Gratuity Valuation, AS15 R (Accounting Standard 15 Revised), IND AS 19, Actuarial Valuation

For More Information: https://www.mithrasconsultants.com/

Call Us

Call Us Whatsapp Us

Whatsapp Us